The Ultimate Guide to Delivering Business Advisory Services

The Ultimate Guide to Delivering Business Advisory Services

Table of Contents

1. Your Business Advisory Mindset

2. The Three Most Important Mindsets

3. The Skills You Need To Deliver Advisory

4. The Three Essential Business Tools

5. The Power of the Annual Business Plan

6. The Value in a Forecast

7. Ongoing Reporting and Accountability

8. Taking your clients on an advisory journey

9. The Business Advisory Process

10. Delivery is King

“Our clients don’t need Business Planning as a service. If they did, they’d ask for it.”

We refer to this belief as denial. Remember the Tom Ford quote - "If I had asked my customers what they wanted, they would have said a faster horse."

“We offer Advisory services, but our clients won’t buy unless the bank needs it.”

Ineffective marketing is likely the culprit. Using accounting jargon instead of plain English and expecting a website to do all the work is a common mistake.

“We know we should offer them, but we need to get our ducks in a row first and we’re flat out with our current workload."

When it all boils down, these are excuses getting in the way of helping your clients achieve their business and lifestyle goals.

Until accountants recognise the fact that they have a duty of care to teach their clients to run a better business, we’re not going to see any massive change. We’ll be talking about Advisory for another 20 years.

Until accountants recognise the fact that they have a duty of care to teach their clients to run a better business, we’re not going to see any massive change. We’ll be talking about Advisory for another 20 years.

Three mindsets that are fundamental for Advisory

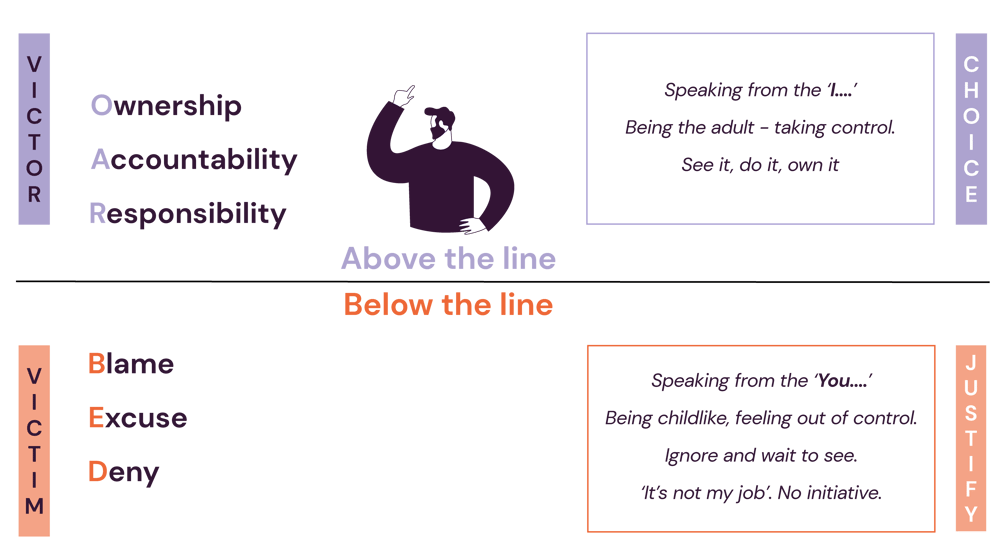

The OARBED Behavioral Model

OARBED is one of the most powerful behavioural models around.

It isn’t just a model for business behaviour, you can use it extensively in your personal life.

It’s a human tendency to blame other people or circumstances when things don’t go according to plan. It’s easy to make excuses for not giving clients the support they deserve. We can always blame difficult clients who drain our time and energy. We can all find excuses for not doing what’s important, such as not prioritising implementing that new practice management system. We can even deny that clients need more than compliance , after all, they aren’t asking for it.

Yes, we all think below the line from time to time, however, if you want to deliver tangible Business Advisory services and get the financial return you deserve from your efforts, then we need to act above the line. We can do that by taking ownership and letting go of our most difficult clients, for example. Or instead of denying that clients need these services, we could take accountability, hold some complimentary client meetings, and get closer to their problems and challenges so that we can offer solutions in the form of new services. We also need to take responsibility for the things we can change. We could delegate the implementation of that new practice management system.

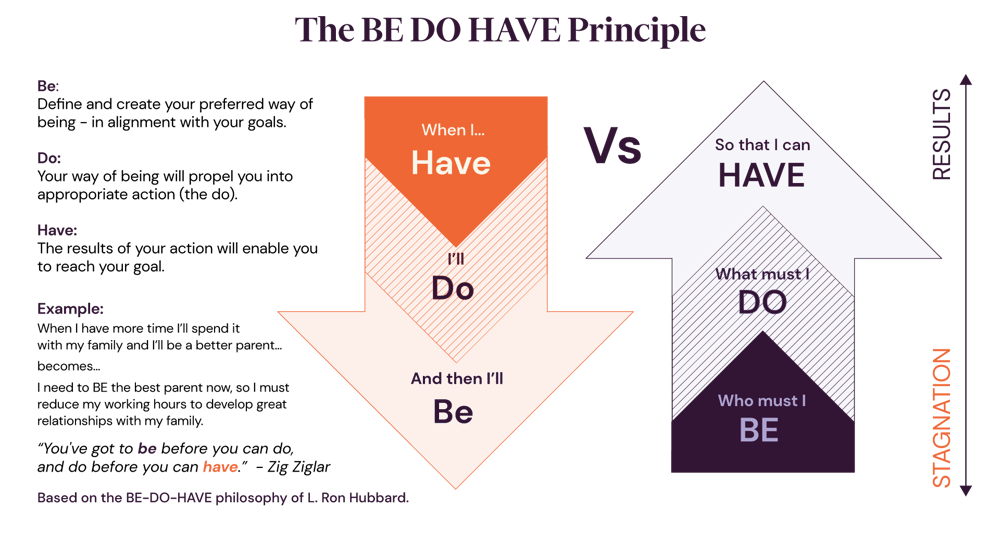

The Be Do Have Principal

When we think about implementing Business Advisory services, we tend to start with

– when I have more time, I’ll deliver Business Advisory services to my clients and be more supportive.

The Be Do Have Principle turns the natural have, do, be rational on its head. I need to be the accountant that provides more support to my clients now, so I must get rid of that client who is robbing me of my time and energy and then I’ll have the business that I deserve to have.

Start with who you want to be.

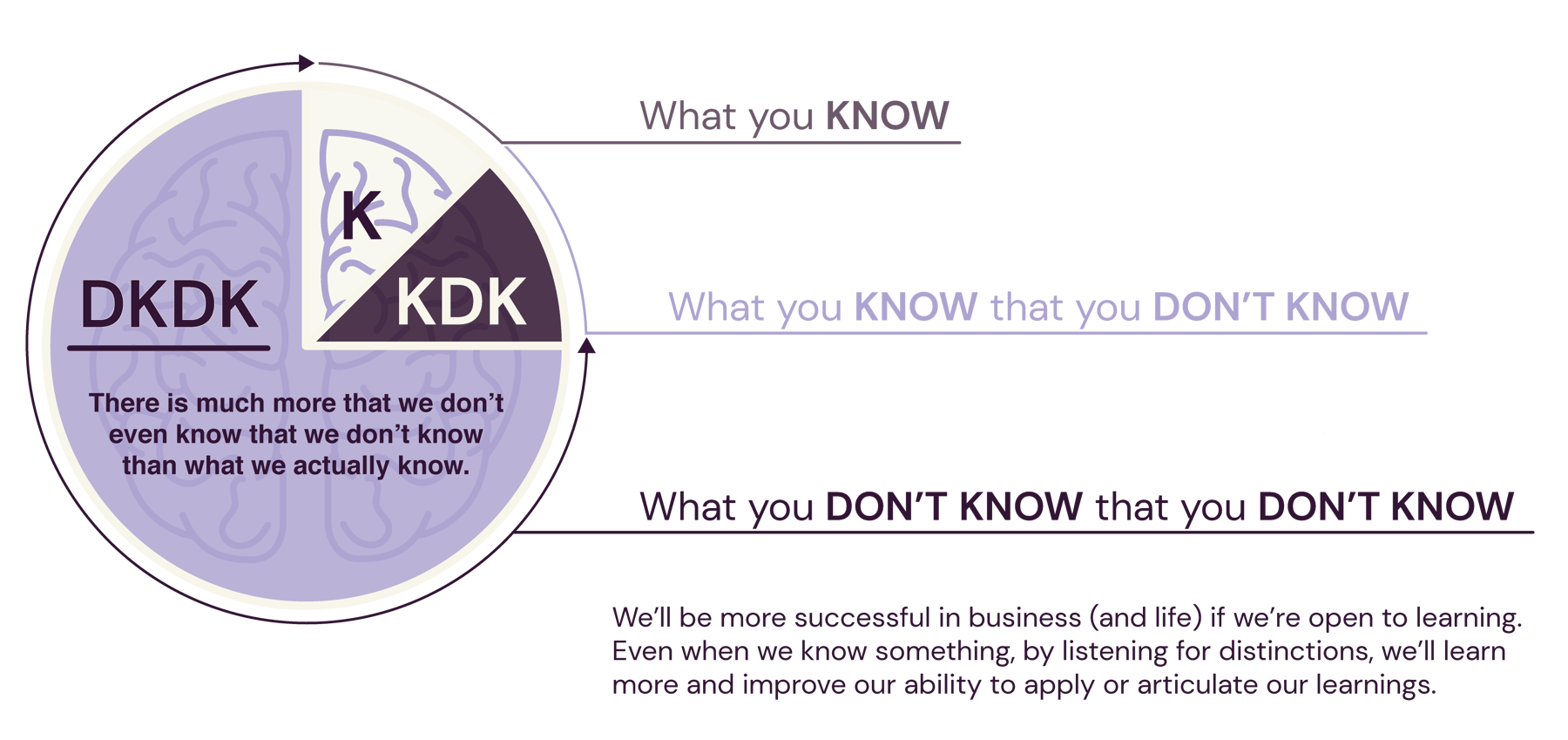

No 'I know' thinking

We don’t know what we don’t know.

For example, you may ‘know’ that a particular client is very self-sufficient and will never buy Advisory services from you. You know this because when you ask them “How are things going?” or “Is there anything further we can help you with?”, you get a clear “We’re good, thanks”.

What you might not know is that the client doesn’t really understand their numbers, is working 70 hours a week, and the stress from running the business is keeping them up at night. To find out how things really are, we need to ask much better questions; open ended ones, not the ‘yes’ or ‘no’ kind.

To be successful business advisors, accountants simply must speak wider than the numbers.

We believe that the seven most important traits of today’s accountant are:

- A very good accountant

- Ability to numerate

- Rounded tax knowledge

- Commercial (the ability to speak wider than the numbers)

- A very good communicator

- Ability to sell (with training)

- Empathy

Our industry has always focused on the first three in the list, but not so much on the last four. These are the four neglected skills in our industry, so we must be prepared to invest some time to upskill.

What is Business Advisory, anyway?

We believe there are two types of Business Advisory services:

- You as the expert. With these services, you pretty much do the telling. After all, you’re the expert. Tax Restructuring, Due Diligence and Share Valuations are all examples.

- You as the coach or facilitator. With these services, you’re not the expert on their business, so you ask, don’t tell. Examples include Business Planning, structured accountability coaching and Succession Planning. These services provide enduring value for your client.

It sounds simple, yet there are so many businesses who don’t do these three things.

They carry their plans around in their heads and expect their team and their bankers to know what their vision and goals are. Even worse, many accounting firms promote services such as Business Planning on their websites when they don’t have a Business Plan themselves!

Here are seven simple rules for Business Planning:

- It must be done EVERY YEAR. It’s simply best practice in business.

- Keep the Business Plan to one page (two sides).

- Have no more than four annual goals, with cascading 90-day goals and actions.

- Have no more than five KPIs (Key Performance Indicators) in the plan.

- Share the Business Plan with the team (sanitised for sensitivity if needed). Link their career goals to the Business Plan.

- Make progress towards the Business Plan highly visible to the team. Celebrate success along the way.

- Review the Business Plan at least quarterly.

Most of your clients aren’t self-starters.

Most clients will benefit from someone independent who sees their business from a different perspective, facilitating the planning session and holding them to account regularly. That’s you! When clients work with you to create and update their Business Plan, you’re combining their expertise (operational) with yours (experiential, financial, strategic). 1 +1 = 5.

In most accounting firms, the majority of Forecasts get prepared because clients ask for the service, usually driven by a bank request.

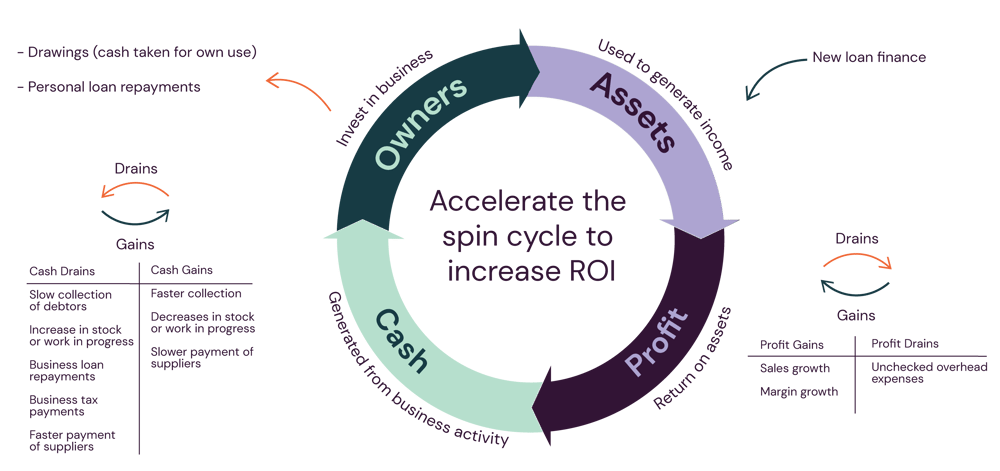

Our basic proposition to the accounting industry is that every real business deserves to understand how their cash flows (or doesn’t!) and that forecasting and cashflow coaching should not be a marginal, on demand service.

It’s our job as accountants to take a stand for business success and therefore teach clients best practice. Best practice is to understand your business’s cashflow cycle and therefore improve your cashflow.

.png)

Having a robust forecast, and the opportunity for cashflow improvement coaching, means clients can achieve the three freedoms in their business:

Time freedom - less time juggling bills, overdrafts, and bank managers!

Mind freedom - less stress and worry, better relationships with suppliers and bankers, and better sleep.

Financial freedom - more cash as a result of understanding cash drains and the cash gains achieved by changing business processes.

Forecasting is the first step in better cashflow management and therefore better decision making. Let’s teach our clients that.

The Business 101 Cycle

Having an annual Business Plan and an annual Forecast is pointless if clients can’t see how they’re tracking to their plan. It’s an obvious statement that they need reliable reports in real time to do that.

But it can be hard to sell reporting as a service. Where is the value for clients? How many actually read, let alone understand, those reports?

For our clients to value their management reports, we need to bring those reports to life. The easiest and most supportive way to do that is to wrap an accountability service around the numbers. We call that coaching, but if you don’t like the word coaching, accountability as a service name is just fine.

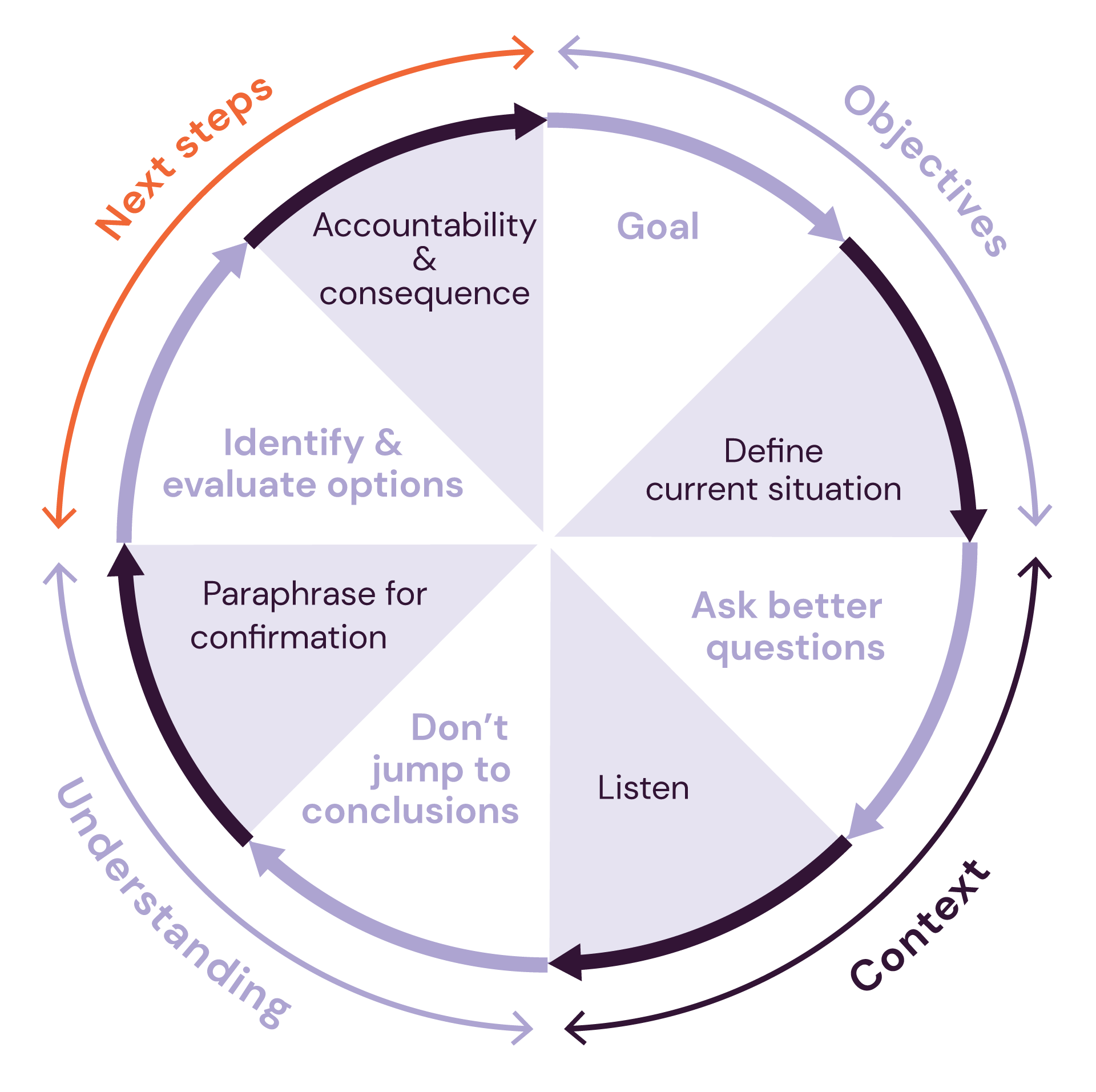

Coaching must be structured or it will evaporate like candyfloss. The structure of coaching includes:

- Client pre-work and self-assessment

- Agenda (determined by their prework)

- The coaching session

- Minutes with actions

- Now rinse and repeat!

The Coaching Wheel

Building Recurring Revenues from the three essential tools

These three services should be delivered on an ongoing basis, creating recurring and sustainable revenue for accounting firms.

Better still, build the Trifecta into your monthly service plans, creating sticky relationships and putting compliance in its place - at the bottom of the value ladder.

Trial The Gap and see the potential for growth in your own business just by focusing on these three services.

%20(1).jpg?width=800&height=450&name=Draft%20Implementation%20Roadmap%20slides%20_%20Value%20Ladder%20and%20Service%20Plan%20slides%20(3)%20(1).jpg)

The Value Ladder conveys the concept of taking our clients on an advisory journey - starting with the first rung on the ladder. The first rung is usually free or something you already include in your compliance fee. For existing clients, it could be an Annual Accounts Review meeting, for prospective clients it could be attending an education webinar you’re hosting or an initial meeting to discuss how you want to work together. Both are great ways to position how you can help.

The next step on the ladder should be a low-cost, low-risk service that enables your clients and prospects to try before they buy deeper advisory services. As your clients move up the ladder, their trust grows along with your relationship and the value of that.

Defining your value ladder

Whatever your advisory offering, defining your Value Ladder enables you to articulate your offering and support your clients one step at a time. This is an invaluable tool when supporting new and existing team members to develop their skills and will help you strengthen your marketing and sales outcomes.

Other Business Advisory Services

There are many value-add Advisory services you can provide to clients beyond the three essential tools.

As you make annual planning, annual forecasting, and reporting with accountability part of your usual Business Advisory offering to clients, you’ll be spending more time with them and get closer to the other challenges and opportunities in their business. As they gain confidence in working ‘on’ rather then ‘in’ the business, you’ll be well positioned to offer support in other areas, such as offering an Organisational Review, a Core Values Development workshop or Governance Coaching.

Clearly define your services and the client benefit of each of your advisory services.

Your Business Advisory services should be clear and present on your website - with concise text that speaks to the value of each service, without potentially confronting accounting jargon. Clients want to know how you'll help them achieve the three freedoms as a result of investing in your service. For example, your web text for Business Planning might read like this:

‘Upon completion of pre-work, we’ll have a greater understanding of your vision for your business, so we can facilitate a four hour planning session to help you create a clear one page Business Plan.

The outcome of this service is to identify and prioritise goals, both short term and long term, create strategies to achieve your goals, enable you to review actual performance against targets and establish a 90 Day Action Plan to address immediate and critical issues.’

For the complete low down on marketing Business Advisory services, read our ‘Marketing Made Easy for Accountants’ resource.

You simply must have a sales process. This includes:

- Your sales approach - how you'll get clients on the first rung of your value ladder, it may be by inviting them to a webinar or by offering a free meeting

- Your standard proposal for each advisory service - naturally you’ll customise proposals to reflect your client’s situation and needs

We have a wealth of sales content and processes to help accountants during that most troublesome of journeys - selling! Be sure to read our ‘Selling for accountants’ resource.

You need a delivery framework

Just as you have a defined process for completing a set of financials, you need a clear and consistent process to deliver any Business Advisory service. Without a delivery system, you won’t be able to grow at scale and you won’t be able to teach your young guns how to deliver these services. Even worse, delivery and client experience across your team will be horribly inconsistent.

So, let’s get to it!

Delivery is King

The test for whether you have a clear process for delivering your Business Advisory services is a three-part one:

- Is the system written down?

- Would anyone else understand the system?

- Does the system include all of the scripts, delivery notes and templates needed if one of your (competent) team members were to deliver the service for the first time?

If the answer to any of the above questions is no, then you don’t have a delivery system.

OK, let’s get into the delivery phase. For any Business Advisory service, let’s use Business Planning as our example, your delivery process must cover the following components:

1. Client pre-work

Pre-work means you don’t end up in a ‘meeting of discovery’. It allows you and your clients to better understand the challenges and opportunities on the table- so you can go deeper in the meeting. Client pre-work consists of a few questions to set the scene, identify problems, and find out more about your client’s goals.

2. Delivery notes

Delivery notes are critical for teaching others to deliver these services. They’ll also ensure a consistently great client experience, every time. Here’s a snip from our Business Planning Delivery Notes. You can see that we split the four-hour Business Planning session into natural segments, with clear guidelines as to what needs to be covered in each segment, along with suggested timings.

Delivery notes are for internal use only. They are your delivery safety blanket. No chance of getting lost or forgetting any critical elements of the process.

/NOTES.png)

3. Agenda

Well-constructed delivery notes will double as an agenda.

4. Business Plan template

You’ll use the same templated process, every time. As you’d expect, every plan, across each client, will be unique. The Business Plan will be emailed to your client as soon as the session ends.

5. Action Minutes (BAMFAM)

You’ll have your standard Business Planning Minutes template open during the session and you’ll populate that with actions that don’t sit within the Business Plan. You’ll also document any follow up work (along with your fee) that needs to be done after the session.

You’ll also capture the points of value, as described by your client, from your time together. This reinforces their learnings and is a confidence booster for you.

Lastly, you’ll document your next meeting date and time. We call that BAMFAM. Book A Meeting From A Meeting. A simple but effective way to add to your Business Advisory ROI, while at the same time, keeping your client on track.

For more detail check out our Business Planning Process Guide.

Your Next Steps

If you’re keen to deliver Business Advisory services, you need a plan. Download our sample Business Development Activity Plan here.

Show that you care about your clients and get started now.

.png?width=2000&height=1052&name=Download%20Banner%20-%20Ultimate%20guide%20to%20business%20advisory%20services%20(5).png)

.png?width=2000&height=496&name=The%20Business%20Advisory%20Trifecta%20includes%20(1).png)

.png?width=2000&height=496&name=The%20Value%20in%20%20a%20Forecast%20(1).png)

.png?width=2000&height=496&name=Ongoing%20reporting%20and%20accountability%20(1).png)